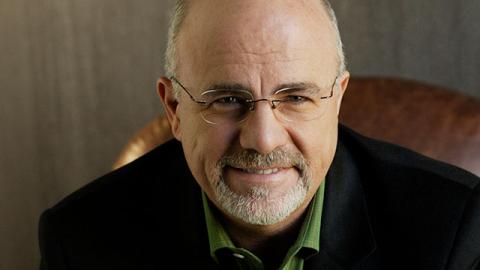

Dave Says: Ready to Buy a House?

Single Guy, Little Debt … Ready to Buy a House?

Dear Dave,

I’m 24, single, and my dad is encouraging me to buy a home on a 30-year note. I’ve got about $6,500 in debt, but I’m using your debt snowball method to pay it off as quickly as possible. I make around $45,000 a year and have discovered I can get a good interest rate on a mortgage. Do you think this is the right time for me to buy a house?

--Jeff

Dear Jeff,

The fact that you can get a good interest rate OR that your dad is urging you aren’t the reasons to buy a house. You need to get out of debt first.

We’re only talking about $6,500, so keep doing the debt snowball and you’ll have that sucker paid off in no time. Also, I never recommend 30-year mortgages. If you can’t afford a 15-year note, then you can’t afford the house – period.

I know your dad loves you and wants good things for you, but you need to listen to me on this one. Once you get the debt out of the way, you can save money like a madman then make a huge down payment on a 15-year mortgage.

If you’ll follow this game plan, Jeff, you’ll have the mortgage paid off and own your home outright by the time your 40. Pretty cool stuff!

-- Dave